The high-purity manganese market may face a deficit as early as 2024, according to people in the industry heard by MINING.COM.

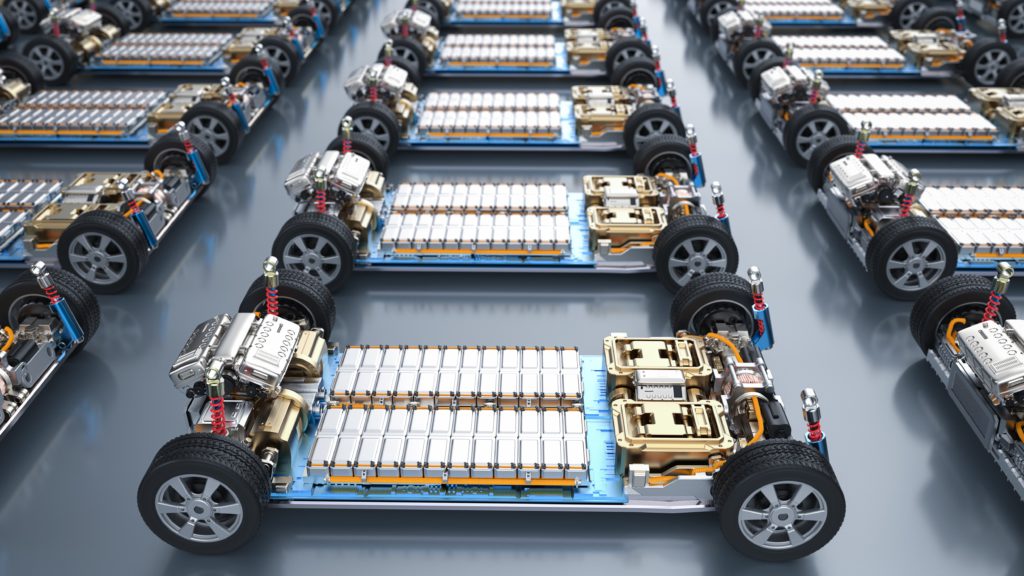

An essential component of the steel-making process, manganese has played an increasing role in the battery market. The metal sulphate is an important stabilizing ingredient in the cathodes of batteries widely used in electric vehicles and electronics.

Volkswagen, Mercedes, Tesla, and GM are among the companies that have announced intentions to use high-purity manganese in their cars. A Chevy Bolt, for example, can contain over 24 kg of manganese.

“The reason nobody is talking about manganese is that it’s very cheap, and it’s taken for granted,” said Andrew Zemek, special adviser at CPM Group.

While the lithium price has skyrocketed over the last couple of years, passing $80,000 per tonne and other metals like cobalt and copper reached over $8,000 per tonne, manganese sulphate costs less than $1,000 per tonne in China.

But increasing demand from the EV industry and the subsequent deficit of high-purity manganese may impact the metal price in 18 or 24 months, according to Euro Manganese CEO Matt James.

“There’s been a build-out of manganese sulphate capacity in China and that has been enough to feed the current demands of the battery industry,” James told MINING.com. “But going forward, we’re going to see significant growth in both the European and North American battery industry. Both of those will require their own supply chains.”

“As the market looks to source locally, in North America because of the Inflation Reduction Act(IRA) or Europe because of geopolitics, when they start to look at the high-purity capacity in both of those regions, it is very very small,” James said.

decades. The company has allocated $55 million of capital expenditure to work on the Hermosa project in Arizona for the current fiscal year and expects to begin a pre-feasibility study before mid-2023.

In Europe, Euro Manganese is developing its Chvaletice Project in the Czech Republic, the only sizeable, classified resource of manganese in the European Union.

The project entails re-processing manganese deposits contained in waste (tailings) from a decommissioned mine that operated between 1951 and 1975.

The company plans to convert the carbonate to high-purity manganese metal and sulphate and send it to Euro Manganese’s planned processing facility in Quebec where it will be converted into a liquid sulphate. The site is adjacent to two proposed cathode plants allowing the liquid sulphate to be piped directly into the cathode production processes.

“Going forward, we’re going to see a European battery industry and a North American battery industry,” said Jaffe. “Both of those are growing at a tremendous pace and are gonna require their own supply chains, including a supply chain for manganese. And when you thinking about moving forward, I would talk about 10 years from now or over the next five years.”