GOVERNMENT has projected that the country will between 2023 and 2031 generate US$5.8 billion in debt service savings following the postponement of payments through extended maturities.

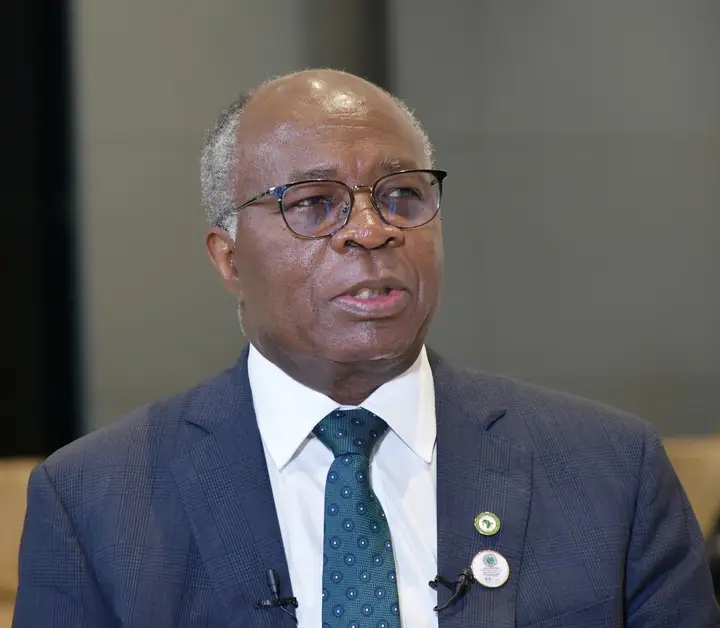

Finance and National Planning Minister Situmbeko Musokotwane also said. the debt had become unsustainable and the country would have ground to a halt if the “New Dawn” had not gotten a debt restructuring agreement.

Dr Musokotwane said Zambia would then be paying its official creditors about $750 million only over the next 10 years, compared to about $6.3 billion that was supposed to be re-paid in the same period, under the previous contractual arrangements.

“In economic terms, or should I say considering the time value of money as described in the International Monetary Fund (IMF’s) debt sustainability framework, the agreement delivers close to 40 per cent reduction of our debt burden as a result of the postponement of repayments and a reduction in interest rates,” Dr Musokotwane said.

He said this when he delivered a ministerial statement to Parliament yesterday, explaining the country’s recently acquired $6.3 billion external debt restructuring deal with the country’s bilateral creditors.

Dr Musokotwane said the stock of external debt in 2011 was only US$1.98 billion but by the end of 2021, rose to $13.04 billion.

He said from accounting for only nine Ngwee of every one Kwacha in domestic revenues to service debt in 2011, the 2020 up-shoot brought to 51.70 Ngwee of each one Kwacha raised in domestic revenues being required for debt repayments.

“With 51.7 Ngwee out of each one Kwacha of domestic revenues going towards debt service and another 39.4 Ngwee going towards wages and salaries for public servants, this meant that 91.INgwee of each Kwacha of domestic revenues raised was committed to debt service and payment of wages and salaries. The balance of 8.9 Ngwee in one Kwacha raised in domestic revenues was what remained for all other Government programmes. This was an impossible task,” he explained.

Dr Musokotwane said if nothing had been done to restructure the debt, then out of each one Kwacha of domestic revenue collected in 2021, 70 Ngwee was needed towards debt service.

“If we add payment of wages and salaries, which was about 43.1 Ngwee of each one Kwacha collected in domestic revenues, it would have meant 113.1 Ngwee in every Kwacha was required for debt service and payment of wages and salaries. In order to service the debt and pay wages and salaries, all of the domestic revenue collected would be utilised for that purpose alone. That would not even be enough and clearly, this would have brought the country to its knees,” the minister explained.

Dr Musokotwane said the restructuring provided debt relief through a significant maturity extension of the country’s existing claims by more than 12 years, with a final maturity in the year 2043.

“Interest rates will be set at a very concessional rate during the next 14 years and will not exceed 2.5 per cent. Principal repayments are starting in 2026 but only for 0.5 per cent, per annum for the period 2026 to 2035,” Dr Musokotwane said.

He said the agreement also included an adjustment mechanism that recognised the uncertainties that existed regarding Zambia’s future debt carrying capacity.

Dr Musokotwane said the adjustment mechanism provided for an accelerated repayment schedule and higher interest rates if Zambia’s debt carrying capacity improved from the current weak classification to medium classification.

“This assessment will be jointly undertaken by the IMF and the World Bank in 2026.

Should the assessment results show that Zambia’s debt carrying capacity has improved from weak to medium capacity; the agreement provides that final maturity will be reduced by five years from 2043 to 2038; interest rates will be higher than the baseline scenario.

“Full details of the agreement will be explained to the House and the Zambian people after we have negotiated and signed. the Memorandum of Agreement with bilateral official creditors,” he said.

Dr Musokotwane said the restructuring unlocked extra funds from cooperating partners and this year, both the IMF and the World Bank would disburse funding to Zambia amounting to $188.8million and $75 million, respectively.

He said the Government was also engaging the country’s private creditors who accounted for $6.8 billion, with bond holders accounting for $3.5 billion.

Dr Musokotwane said reaching an agreement with the official bilateral creditor committee should provide impetus to the on-going discussions with private creditors.