… As stakeholders applaud bold, audacious budget

By STUART LISULO

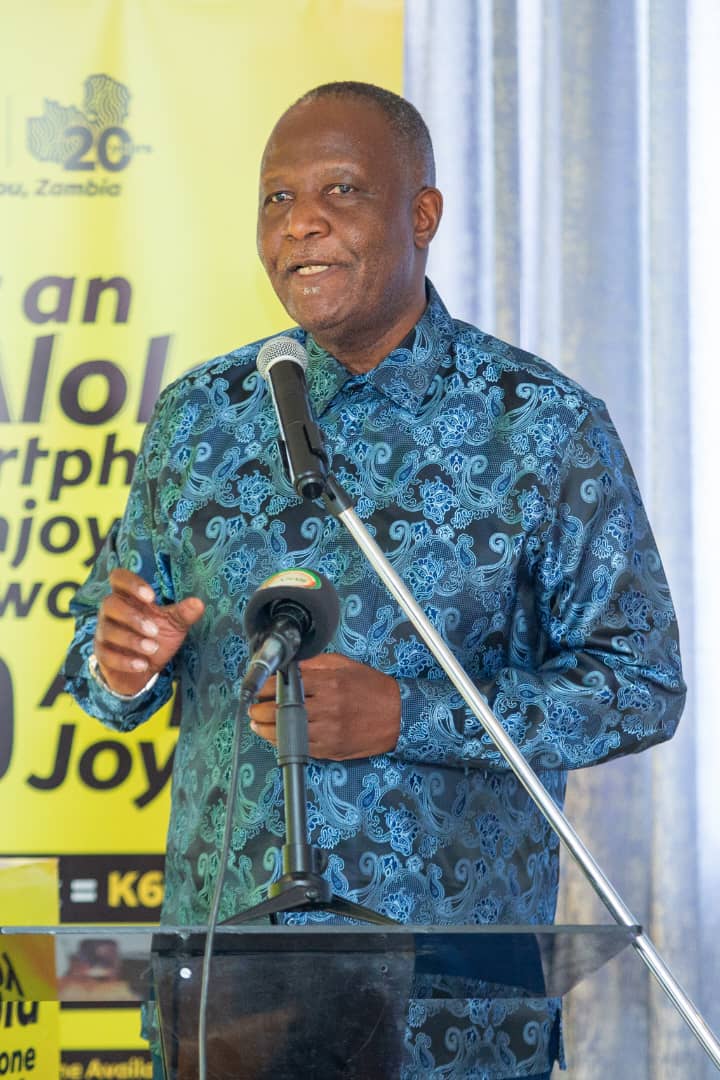

FINANCE Minister Dr Situmbeko Musokotwane anticipates a long process towards the reduction of debt accumulation so as to fund Government programmes.

And a wide spectrum of stakeholders have hailed the 2022 national budget as “audacious”, with some eager for its implementation to effect Government policy pronouncements, which include the ambitious target of recruiting 30,000 teachers and 11,000 health personnel next year.

At the Zambia Institute of Chartered Accountants (ZiCA) 2022 post-budget analysis dinner at Mulungushi International Conference Centre (MICC) recently, various stakeholders dissected the 2022 budget presented to Parliament by Dr Musokotwane on October 29.

The Minister delivered an unprecedented K173 billion budget expected to be passed and implemented from next year.

Among the key measures proposed by the UPND administration will include new expenditure of a staggering K350 million for Small to Medium Enterprises (SMEs) as empowerment funds; a monumental increment of the Constituency Development Fund (CDF) from K1.6 million to K25.7 million, signalling an acceleration of the decentralisation programme; and increased expenditure in both the health and education sectors.

Government will also recruit 30,000 teachers and around 11,000 healthcare personnel next year, partly financed by the International Monetary Fund (IMF) US $1.3 billion Special Drawing Rights (SDR) made available in August, this year.

However, Government’s proposed expenditure on servicing external and domestic debt repayments alone is a staggering K78,680,141,674, or around US $4.5 billion, gobbling almost half of the entire budgetary expenditure.

And according to next year’s available resource envelope, Government proposes to raise a cumulative total of around K74.4 billion by way of both domestic and foreign debt to finance year’s budget, representing around 29 per cent of the total budget.

Reliance on debt to finance next year’s budget has increased to K74.4 billion from K53.6 billion contracted in this year’s budget.

PROLONGED PROCESS

Addressing the question of how Government will stop accumulating debt, Dr. Musokotwane pointed out that managing Zambia’s debt stock to lower contraction will be a prolonged process that could not be completed overnight.

He explained that turning the country back towards debt sustainability was a painstaking process that involved balancing between servicing the country’s developmental needs versus repaying the debt stock.

As such, concessional loans, like the ones the New Dawn administration has signed for construction of secondary schools and health facilities, which spread out over a period of 30 years at 0.5 per cent interest; will continue to be contracted but at a slower rate. However, commercial debt would no longer be entertained.

Debt accumulation would however not be terminated suddenly. Certain categories of debt accumulation would continue because of the negotiation levels reached by the previous PF administration.

He, however, stressed that economic recovery needed “dramatic” measures to kick-start the ailing economy, even amid high debt servicing.

“…But at the same time, you want to do something dramatic on economic growth that will generate more revenues because in a sense, this debt problem that we have of US $13 billion, if the economy is big, US $13 billion is nothing. So, therefore, as you push debt down, you must also do something to raise the level of the economy so that it can be able to handle the level of debt that you have,” he added.

And responding to various questions from the packed auditorium, Dr Musokotwane said Government placed a higher priority on the education sector given the higher number of beneficiaries who would benefit from subsidised education.

Government has removed tuition fees for the school-going population to increase the number of secondary school graduates.

PAYE

The minister explained that while he would have loved to reduce PAYE, and while he was aware that the cost of living had escalated, causing a lot of stress all across the economy, the resource envelope was too limited for Government to give back to tax payers.

“What were the competing needs? They were raising the minimum threshold. But there were other competing needs. It included education, teachers, it included the fact that a lot of young boys and girls are unable to go to school, mainly because of the K600 that they were being asked to pay and, of course, many other competing requirements. So, we had to weigh, in our assessment, Government paying the fees for these secondary school children, we were giving to a broader spectrum of people. The tax relief you are talking about is only relevant to people who are in employment. But when we pay school fees of children out there, the number of beneficiaries is much larger.”

And a blend of economic and social players hailed the 2022 budget as progressive, brave and even audacious.

Ishmael Zulu, a Policy Officer for Tax and Equity at Tax Justice Africa, expressed optimism and hope that the 2022 budget would be implemented to meet the various macroeconomic objectives.

He observed that there was sufficient political will required to achieve and implement the strategies to accelerate economic recovery.

World Wide Fund (WWF) Chief Conservation Officer, Isabel Mukelabai, however, observed that the budgetary allocation towards environmental protection had remained extremely low.

Analyzing whether next year’s budget was “green enough”, Mukelabai said that the WWF wanted Government to implement a Green Jobs Strategy to create employment opportunities and boost overall job creation.

She expressed delight at the establishment of the Climate Development Fund, but questioned whether this would be implemented to enhance environmental protection in the country.

“…In principle, the thinking is correct, but the execution is lacking,” she said.

But Mukelabai, a veteran in the NGO sector, commended Government for the “bold” budget and looked forward to its implementation.

Humphrey Mulenga, a Deloitte managing partner, assessed the budget in the context of resetting the Path for Zambia’s Sustained Economic Growth, together with Dr. Patrick Chileshe who analysed the economic outlook.

Mulenga advised Government to seriously address the high youth unemployment levels as a major problem that needed solving to grow the economy, while also cautioning against incessant domestic borrowing to avoid against rapidly accumulating the domestic debt stock.

Zambia’s total debt stock has come under immense pressure from mounting domestic debt, mainly derived from government securities at above K180 billion by June 30 compared to K143.84 billion at the end of the first quarter of this year.

But he described the budget as “transformational” in view of the tax measures proposed to take effect from January 1, 2022.

Among them include the raising of the Pay As You Earn (PAYE) threshold up to K4,500 from the current K4,000, the slashing of the standard Corporate Income Tax rate to 30 per cent from 35 per cent and the reintroduction of the deductibility of Mineral Royalty Tax (MRT) for corporate income tax assessment purposes, widely proclaimed as the “game changer” to stimulate further Foreign Direct Investment (FDI).

Leave a Reply