By John Chola

Zambia’s healthcare and financial sectors received a significant boost as the Saudi Fund for Development (SFD) and the Zambian government signed two landmark agreements on Thursday, December 26, 2024.

The event, held in Lusaka, marked the allocation of an additional US$35 million concessional loan for the Lusaka based King Salman Bin Abdulaziz Hospital project and the formalization of a bilateral debt restructuring agreement under the G-20 Common Framework for Debt Relief.

Sultan Al-Marshad, CEO of the Saudi Fund for Development (SFD), expressed the Fund’s commitment to Zambia’s development, describing the King Salman Hospital project as a beacon of progress and partnership.

“This additional loan brings our total contribution to US$135 million for this state-of-the-art facility, which will feature 800 beds specializing in maternal and child healthcare, advanced medical equipment, and comprehensive staff training programs,” he said.

Al-Marshad underscored the transformative potential of the hospital, stating, “This is not merely an infrastructure project; it is a symbol of our shared commitment to providing high-quality healthcare for Zambians. It will create jobs, enhance the healthcare sector, and contribute to Zambia’s social and economic growth.”

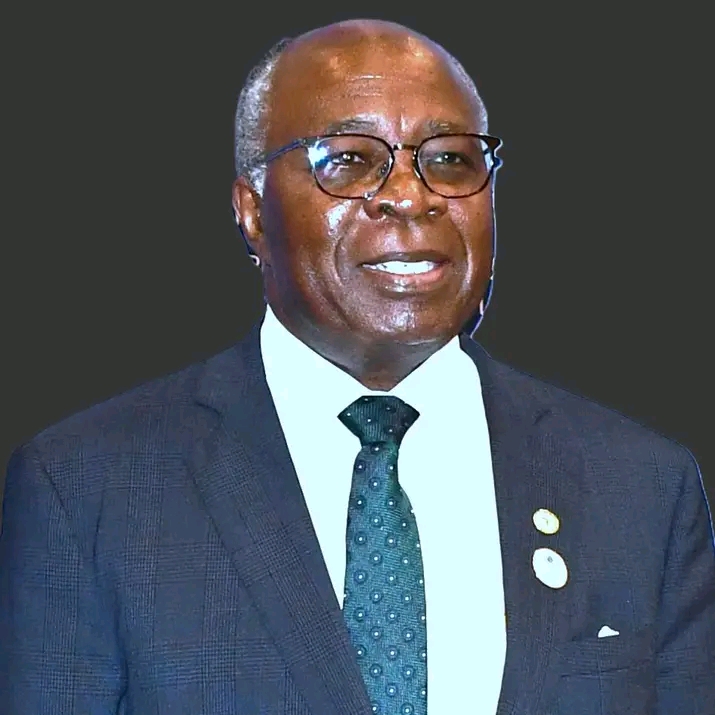

Zambia’s Minister of Finance and National Planning, Dr. Situmbeko Musokotwane, praised the partnership with the Saudi Fund, calling the agreements a testament to mutual dedication to Zambia’s progress.

“The King Salman Hospital, nearing completion, will serve as a center of excellence and a regional referral hub for maternal and child healthcare. This milestone underscores SFD’s invaluable contributions to our health sector,” Dr. Musokotwane said.

In addition to the healthcare milestone, the signing of the bilateral debt restructuring agreement highlights Zambia’s strides toward fiscal sustainability.

“This agreement formalizes our shared commitment to restructuring Zambia’s debt, ensuring fiscal stability, and fostering economic growth,” Dr. Musokotwane noted.

He further commended the Saudi Fund’s role in constructive dialogue, which he described as “a symbol of trust and partnership that will inspire confidence among other creditors.”

Zambia owed US$4.5 billion to Western private creditors: US$3 billion of foreign currency bonds, the largest known holder of which is BlackRock, and a further US$1.5 billion as direct loans to Western private creditors, such as Israel Discount Bank (US$362 million), Investec (US$351 million) and Standard Chartered (US$268 million).

Further, Zambia owes US$1.4 billion to Chinese commercial lenders, US$2.8 billion to Chinese bilateral lenders and US$1.1 billion to other governments (the largest being India US$300 million, UK US$240 million and South Africa US$157 million).

The average interest rate on the Western private loans is 7 percent, compared to 5.2 per cent on the Chinese commercial loans, 3.9 percent on the Chinese bilateral loans and 1.6 per cent on the other government bilateral loans.

Zambia owes a further US$4 billion to multilateral institutions, which is not factored into the debt restructuring.

Both leaders emphasized the significance of these agreements in shaping Zambia’s future.

“Together, we are paving the way for a healthier and more prosperous Zambia,” said Al-Marshad, while Dr. Musokotwane concluded, “Our collaboration with the SFD reflects Zambia’s resilience and potential to contribute to global conversations on development and financial stability.”

As Zambia moves forward, the twin agreements signal a bright future built on international partnerships and shared goals of progress and sustainability.