Zambia said on Thursday it had reached an agreement in principle on restructuring $3 billion of its international bonds with a key creditor group – a milestone in its drawn-out debt rework process.

The deal proposes to restructure claims on three existing bonds by issuing two new “amortising” bonds – in which repayments go towards both interest and principal – maturing in 2035 and 2053 respectively, under an economic “base case” scenario.

The second note would also mature in 2035 and ramp up coupon payments, if Zambia’s economy performs better.

According to the agreement, the face value of the new bonds would stand at $3.135 billion in both scenarios, exceeding the original $3 billion face value of the old notes.

The nominal haircut is calculated at 18%, but that includes the $821 million of past due interest (PDI) that the country stopped paying since it defaulted. The deal would deliver $2.5 billion in cash flow relief for the duration of the country’s $1.3 billion IMF programme, set to expire in late 2025, the ministry said in a statement.

Zambia was the first African country to default in the COVID-19 era, in late 2020, but its restructuring process has been beset by delays. International bondholders also complained they were left out of the process, which started with drawn-out negotiations with bilateral creditors including China.

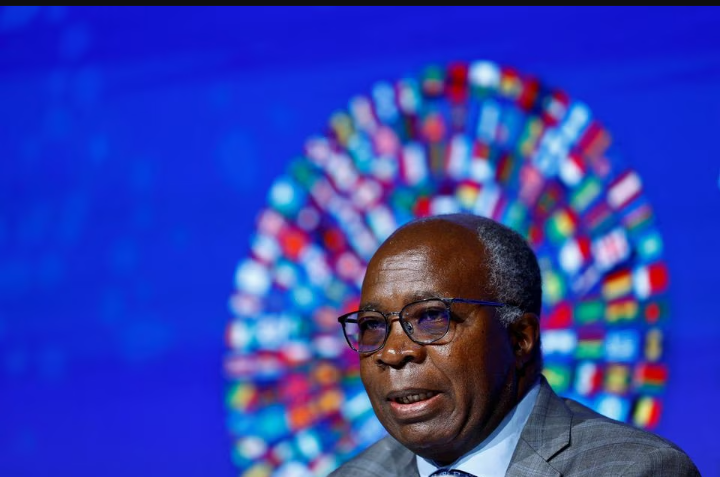

The agreement “paves the way for similar restructuring agreements with our other private creditors,” Zambia’s finance minister Situmbeko Musokotwane said in a statement.

“We hope for the swift implementation of this agreement in principle by the end of the year.”

Zambia’s three international bonds rose sharply after the announcement, adding as much as 3.9 cents on the dollar, Tradeweb and MarketAxess data showed. The 2024 and 2027 bonds were bid at or just under 60 cents in the dollar. ,

In a separate statement, the Zambia External Bondholder Steering Committee welcomed the agreement, saying it would “restore full international capital markets access to Zambia and encourage long-term investment in the country.”

The deal allows for a better and quicker payout to bondholders in case the economy performs better than expected during an observation period running from January 2026 to December 2028.

To trigger this, the country would need to see either a rise in the composite indicator that would signal a higher debt carrying capacity, or that hard-currency revenues would exceed IMF projections on a three-year rolling average.

Under both of the deal’s economic scenarios, the new $2 billion 2035 bond will amortise from 2023 onwards while paying a 5.75% coupon until September 2031 and then 8% until maturity.

However, the second $1.135 billion bond is designed to amortise in three equal instalments paid in 2051, 2052 and 2053 and a 0.5% coupon in the “base case” scenario. In the “upside case” the maturity would be brought forward to 2035 with amortization from 2032 onwards, and interest payments will step up three times.

This “step-up” bond is a first in sovereign debt restructurings and similar instruments could be options in future debt relief processes, a source familiar with the thinking of the bondholder committee said.

It was not clear if the bond would be eligible for inclusion in JPMorgan’s Emerging Markets Bond Index (EMBI), said the source, who spoke on condition of anonymity.

Inclusion in major fixed income indexes generally boost liquidity of an instrument.

In a next step, the government needs to put the agreement to a vote of bondholders, a so-called exchange offer, which needs to be launched no later than the third week of November, according to the statement, as first amortization payments kick off in December.

The committee of bondholders owns or controls 40% of the outstanding bonds, Zambia’s finance ministry added.

Members of its steering committee – which generally takes the lead on any negotiations – are Amia Capital LLP, Amundi, RBC BlueBay Asset Management, Farallon Capital Management and Greylock Capital Management, according to the committee statement.