Official statistics have revealed that Zimbabwe’s annual inflation rate has skyrocketed to more than 250% from the 191.6% recorded in June, its highest level for a year and a half.

The authorities blame the after-effects of the coronavirus pandemic and the high global prices on fuel, grain and fertiliser for the inflation which quadrupled since February.

Many Zimbabweans are struggling to cope as a local shortage of American dollars to pay for imports has also contributed to the rising cost of basic goods including bread and services.

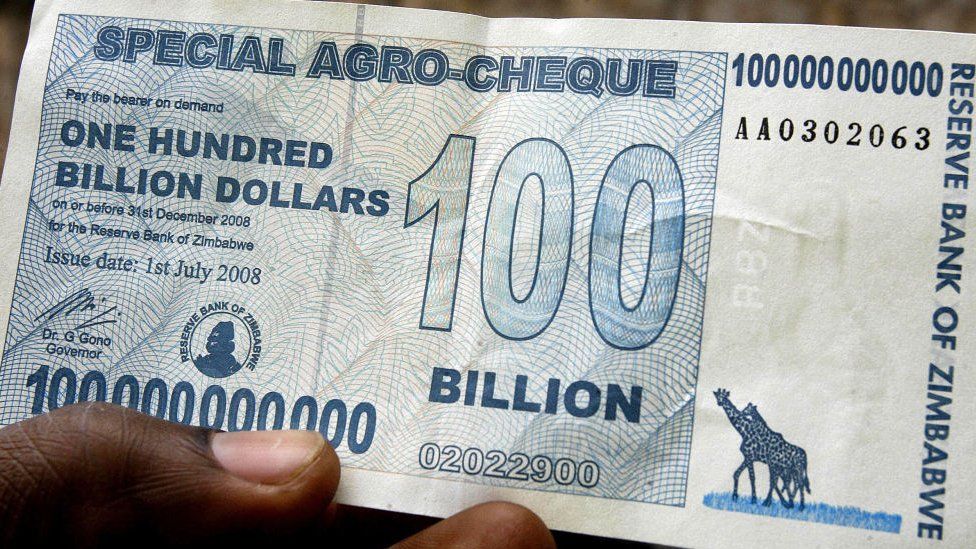

Rising prices revive memories of hyperinflation seen more than a decade ago when inflation spiralled so far out of control that the central bank in 2008 issued a 100-trillion-dollar note, which has now become a collectors’ item.

The government then ditched the local currency and adopted the US dollar and the South African rand as legal tender.

But in 2019, the government reintroduced the Zimbabwean dollar, which has rapidly been declining in value.

On Monday the central bank released gold coins onto the market in an attempt to stem inflation by curbing the appetite for US dollars.